Someone at Standard Chartered Bank decided that they don’t want me to download my last TAX Year’s statement from the web. The only way to get a copy is to pay them for it. And even then, it is manually done, and not immediate, and they can’t help whatsoever with my emergency unless I visit a branch during working hours.

What kind of a strange belligerent person wakes up one morning and decides to do weird shit like this?

This reminded me of hundreds of UI/UX issues with their platform that I have faced in the last year or so. So I wrote down a little rant in the hope that someone in their team will notice how weird their UX is.

- Let’s say it’s the 31st of the month and you have already paid your previous Credit Card due and you get your new salary so you just go in to check how much you owe next month on your credit card. Do you know what you will get?

- A Current Balance that does not match the total amount you spent because transactions made more than 20 hours ago don’t appear yet

- If they are pending, why don’t you just show that they are pending?

- Why can’t I even see how much is pending/stuck/blocked?

- But that’s not it, the Minimum Payment Due amount displayed is from the bill you already paid last month! It’s not the predicted due, or the real due. In reality, my MPD is 0 because I already paid 20 times this amount and cleared off the card! But not according to whoever designed this!

- Who in their right mind writes DR beside a money field and doesn’t even add a space? What does this even mean?

- A Current Balance that does not match the total amount you spent because transactions made more than 20 hours ago don’t appear yet

- Want to send someone a little money very quickly?

- No! You must “remember” if it’s going to be in the bank or outside (who in the holy name of Pinocchio ever memorized what bank their friend uses?) and then you have to go into one of them to look for them. Why couldn’t I just search their name and find whatever account they have?

- But haha, that’s not it. You must then go through a non-searchable table to find their account, with their bank names appended weirdly to the string almost as of Little Gnomes coded this, and then you have to press a “Transfer” button beside each row to send to them! What’s with this terrible UX? Imagine that I have 500 beneficiaries. How will I search/filter? Why can’t I keep a note with each beneficiary to keep track of which account is for what purpose?

- Who decided that I should not be able to download my last year’s statement other than calling you guys and paying you for it? What purpose does this serve other than to annoy me and squeeze some money out of me? Why would you make it terribly inconvenient for me to pay my taxes? Who approved of this?

- BRAC Bank allows me to download this in one click. Your excuse is null.

- The download that you do allow me to take says “Transaction History” instead of “Statement”. Understandable. But you do also realize that Bangladeshi TAX people are annoying AF and they don’t consider this as a statement, don’t you? What’s with this wording game!

^ That’s the Statement I am usually sent via Email.

^ That’s the statement/history that I can download. Not the same stuff.

- Also, here is the funny part: you guys didn’t send me emails for a couple of months to my email (I presume technical difficulties) and I have no way to get them to be resent or see a version of it on the platform – although the platform has a whole section called “Mailbox”. Wut.

- But I can just call and get it, right? That’s not as simple as it sounds either. I need to call you guys and listen to a useless IVR, wait 10 minutes on a call that costs me a 1/8th portion of my kidney, and then wait a whole day to get a digital statement emailed over? What? You do realize it’s a digital statement that should be a button somewhere, right?

- Did you guys ever realize that every time I need to unlock my credit card, I need to spend a minimum of 40 bucks to call you guys? Why couldn’t you just put it on the app? You are wasting your own time too! EBL has a button for this! Like, literally – a button that saves me 40tk every other day would be nice to have, no?

- Did you realize that your forced-logout screen has no option to log back in again? Sometimes I have to check for multiple things outside the platform, and get logged back out even though I am right there on the screen! The TTL for this is too low. Also, what’s this “Continue To Logout” button doing here since I already have been clearly automatically logged out -_-

- What is that “Bangladesh” name on the top left doing? Why can’t I even go to the homepage without editing the name on the address bar?

- Pressing the back button here brings up that weird modal >_<

- But let’s say I love you guys and want to call you at 2 AM to speak about my hidden agenda of creating a wizard state in Gaibandha or someplace near a lake so that my squid can have a good time with its grandchildren. When I call the support hotline:

- Hotline does not remember my language preference next time.

- I have to type in the 16 char card details every time, although I have it paired against my number and it should be unnecessary.

- When the waiting line gets cut off (after around 5 minutes), nobody calls back (when they are more available). I mean, I was waiting for you guys for a while. I atleast deserve a call-back when your lines are less busy.

- When I call back, I have to wait for a long time again instead of being put ahead of the queue. There really is no queue, which is something I feel should be a given.

- The agent manually checks whether I called from my registered number as I wait and accrue an unnecessary bill. Which is weird.

- The Agent asks me every time whether I use online banking, although they should really know that I do or that I said last time that I do. Or that I said the time before the last time that I do. Or that I said the time before the last time’s last time that I do. I have said this like 50 times already. Why is nobody keeping a note?

- On the homescreen, exactly who do you expect to copy-paste that URL to read that text? Why is that information not inside a CTA, let alone contextually delivered where it matters?

- Why isn’t the Credit Card Usage (which is the important number) displayed on the home screen? What good does it do for me to know my remaining credit (a number that I barely care about unless it’s once a decade decision to buy too much and regret later)? The only useful information on this screen should be my current outstanding or my future outstanding sum.

- A standing order has absolutely nothing to do with paying a bill. These are not properly grouped. In reality, I only click this button when I want to pay the bill itself. Please don’t combine them and create an additional click.

- You know that I have only one card – so this message (Combined limit across…) is displayed unnecessarily for me! And this is probably the same case for a majority of your customers. A better UX would be when this is only displayed for clients who do have multiple cards.

- I am on the Card Details screen – and you know whats’ the most important thing (that is missing) here? My bill amount for the next month (whatever I have used till now).

- Okay, I annoyingly agree that clicking that “Card History” button is necessary for me to understand my bill. But the interesting part here is that the top line, “Current Balance” is my future bill (my billing date is in a few days). The line below it, “Minimum Payment Due” is my minimum due from last month. And the “Due Date” here is from last month’s already-paid bill. I mentioned this on Number One – but I am mentioning this again because I see this problem once a week and I really need you guys to understand how annoying and abnormal this is.

- Now, coming down to the portion below it – is my actual usage in the past month. All good – looks okay. Except, they are ordered like some 3-year-old child decided to organize it – oldest transaction first – with no way to see the latest transaction first. If I am ever on my statement, I need to see the immediate ones first. Not what happened 30 days ago! At least have an option to manually reorder?

- And then, why do I have to press the “Next” button here without any pagination? Where is the numbering for these transactions? If I have 300 transactions in a month, I will have to press the next button 30 times to reach the end. Thankfully I am still poor and don’t have to – but can you imagine being rich and then stuck with this interface?

- And you know what’s more annoying? The fact that nobody realized that I might want:

- to order by the largest/smallest transaction,

- alphabetically by the merchant,

- grouped by the merchant

- or even grouped by the transaction type (online, offline, regulars, food, etc)

- Another annoying part about this transaction page is that you can’t understand what a certain transaction is about because the bank always writes weird stuff like “AUTO DEBIT” but not why it was debited. Like – fine, maybe I owe some money for some transaction. But why couldn’t you just write that this was payment against XX transaction or EMI and XX amount was taken because of XX issue? How does it hurt to keep me informed? Payment received against what?

- Similar to this screenshot above, I can’t even see/understand which one of my transactions was an EMI transaction, or how many months’ worth of EMI I took against that transaction, or how much was paid.

- I just want to take another line to press on how much important it is for me to be able to see my EMI Details when the bank does not offer me any! Why am I not allowed to see how much I have paid and how much I have left to be paid in one single screen?

- I know it’s petty to be mentioned again – but I only have one bank account on that list. Why couldn’t you auto-select it? It looks like a guy who plays Russian Roulette but with one chamber filled with a bullet already.

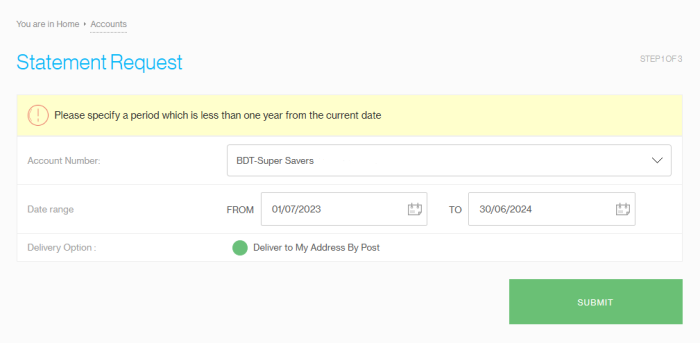

- Weird selection behavior is actually present across the application. For instance, the “Delivery by Post” option is pre-selected and does not allow me to change it. In that case, why is it displayed like an option?

- You might be thinking – okay this guy is annoying and he is just being petty. But wait – here is how petty your interface is:

- Forces me to select “Single Select” options manually, including showing options that are pre-selected (not changeable) in the same UX as changeable ones (causing lots of agitated clicks on my end).

- Shows me a “Statement Balance Due” when the balance is clearly paid over 20 days ago.

- Shows me a “Minimum Due” amount that is not true (due already paid).

- Displays a “Pay On” date that cannot be changed.

- Yes, I know this one I have mentioned twice too. But I just want you guys to know how stupid this is because I felt I didn’t complain enough.

- An interesting fact about this dropdown is how annoying something as inanimate as this can be. Why couldn’t you just list down:

- Unbilled Transactions

- Sept 28 – Oct 27

- Aug 28 – Sept 27

- And more of this – like normal people who have no problem with displaying transactions from the past and don’t have to charge money for it?

- Have you guys realized how hidden your options to report a stolen card or request a billing date change are? I had no idea half of these services were available online until I did this audit!

- Have I complained about the MailBox UX before?

- No filters

- No pagination

- No way to archive

- Really horrible message UX (have you guys opened these to check what this looks like inside?)

- No bulk options like “Mark All as Read” or even “Select All”.

- You can only see 5 at a time almost as if I am using the internet back in the times of Godzilla

- No threading – as in showing the “Bill Payment/Wallet Request Submitted” message and the subsequent “Bill Payment/Wallet Transfer Request Successful” message in one single thread – thus not causing notification fatigue.

- Not displaying time in 12hr format (or at least giving me the option), as is the regular custom in Bangladesh.

27. I know this is a feature request – but why is there no option to download a CSV of transactions here?

- Did you ever realize that Mobile Topup is hidden in the interface? I have to go to “Bill Payment & Wallet Transfer”, and then go to “One Time Payment”, and then select “Mobile Operators”, and then find that Skitto isn’t even listed on your platform even though it still lists Banglalion – a company that doesn’t really exist anymore. Eeks.

- Did you ever consider “Auto Debit” for phones/bKash? I always send a specific amount of money to certain phones (as recharge) or certain people (as a transfer) that I cannot automate through the platform. Which is just awkward. It is a feature request, but someone should have thought of this before.

- Fun fact: if I go through the platform and “Add a Payee”, I can then add my own number as a “Payee” that I can later use to recharge my phone. But the interesting part is that this “Mobile Topup/Recharge” comes up with an ETAC SMS that reads “Your eTAC for Biller/Mobile Wallet Addition …” – both of which are wrong and grossly misleading!

- The better fun fact about this is that although I can add this payee, this payee does not appear on the “One Time Transaction” Screen in any way. This means I must again memorize whether my payee is already saved or whether they are on a different screen. How difficult would it be to merge these two screens into one single interface? Just let me add during the action instead of having a separate screen for it.

- Who in their right mind thought of 10 character eTACS? Like, why is it even necessary?

- If I am on the app – it does not auto-detect – almost as if to remind me that I live in the early 20th century.

- So now I have to memorize a 10 character number so I can type it in

- If I forget, I have to go back and check it and come back and type

- I know I am repeating myself – but this is just downright annoying and a 3 Character PIN would have done fine in this scenario without any issue. If bKash can do it with 4 characters – you can too

- All “Services” are under “Help & Services”, but strangely, “Change Fund Transfer Limits” is under the main dropdown. Why? How is this important enough to be here? How many people actually use this regularly?

- You know what would be nicer instead? The ability to see all of my login details (and activity history) from this screen. Because you only display one single (last) activity here, and it is annoying because if anybody had really hacked me, all they would need to do is to understand that I don’t memorize when I last logged in and that this information is useless to me unless it is compounded with more useful information.

- A fascinating part about this screen is that it allows me to do nothing productive.

- Does not allow me to change my email or add a new one

- Does not allow me to get SMS notifications to a separate device in any different way

- Does not provide me with an API or a Secure Feed (too much to ask, but I just wanted to splurge)

- Does not provide any other way to get alerts whatsoever (what if I want to set up a special alert every time there is a foreign transaction)

- It’s as useful as this point.

- Okay, this will be the last one: why do you guys show me a “Standing Order Payments” page and then not allow me to create any standing order on my own right here?

- Also, “No Records Found” is very different from “No Records Exist”, and they are very different things when it comes to sensitive financial data.

- When I call from a different phone number, I am asked by the agent to call back again from my registered phone. Firstly, its a terrible idea that I must memorize which SIM card is registered – and that I can’t register multiple phones. Why can’t you just allow me to register multiple phone numbers against my account?

- When you get your statement (monthly) emails, your credit card statement email looks like this.

- Interestingly, the text here says that my password for the file is my 16 digit account number. In reality, my account number is 11 digits. The 16 digit number here is my card number. Imagine giving your bank account number here 5-6 times and feeling stupid the first time.

- This password is awkward and useless. Why can’t I ever change this? Why can’t I get a new password for my files? Atleast 100 people know my bank account number in one way or another. How is this worthy of being my password?

- You know my name. Why is the email not personalized (pretty please)?

- Today is December 2nd. I am visiting the Card History screen, and it is empty.

- I made a transaction in the morning (SMS and Email were sent to me) but this was not updated here. Makes no sense. I have mentioned this above too that it makes no sense that there is an “updating” delay on transactions in 2021. You reduced my credit limit. You sent me an SMS. You sent me an Email. And you couldn’t update it here on this list?

- Why is this option always limited to the current month/unbilled transactions? Shouldn’t card history display “all” history like every other statement by default?

- The useless “Print Transactions” button on the Credit History screen only prints the current view in the regular dialog, instead of the logical option of allowing me to print/export the whole list fgs. Who needs this? Why are we trying to replace the default Ctrl+P using a button?

- Wait till you see this. Someone decided that the whole Card History option should not have any Excel/CSV output. Really? Really? Why? Who hurt you?

- And oh, no way to filter by transaction type, or value, or date under my Card History. This is not card history guys – this is a Statement History under the disguise of a joke.

- Let’s say I remember a transaction I did in 2020. I don’t remember the month or the date. But I remember what I wrote for its description while making the transfer. You know what’s SCB’s solution to find it?

- Pay SCB 200tk to get the statement, and then search on it. But you have to wait 2 days.

42. Literally no search anywhere on the application? Why?

43. Who decided that it is adequate for you to display the Transfer History limited by 3 months (or 10 transactions)? Let’s say I send someone X amount every other month to settle a loan – right now, there is absolutely no way for me to see how much money I sent that person over the past year without paying you guys for a statement. What a ridiculous proposition! Also, whats the USD Amount calculated from here? Because I did not send that amount in USD. Is it calculated based on current value or value during the time of transfer? Why does it even exist?

- This is what happens when I download your CSV files, saying that the file format and extension does not match.

45. Notice how the Transfer Amount is formatted. Making it impossible for me to see a summation without cleaning the data first. Why was this necessary?

46. I paid my CC Dues last night – when the due was already available on the site, but I had not been mailed a statement until then. Why that work is manually done – I will never understand. But what I want to understand is why was I sent this SMS more than 12 hours later, mentioning that I still have a due amount with the bank. I just paid this whole sum last night, and my due is zero!

47. Interesting turn of events. On the 30th of December 2020, I had a transaction that failed for me for a local payment gateway via my Credit Card. Since the payment failed and did not appear instantly on the SCB Credit History, I paid that sum again on January 2, 2021. But the interesting part is this, on January 2, SCB’s statement to me showed that the amount from both Jan 2 and Dec 30 was successful and that I have to pay the Dec 30 sum as part of my bill for the cycle. Firstly, why didn’t you show me immediately that this was successful? I could have at least received an email, a text, and maybe a line item immediately, no?

Now, sounds like an honest mistake and all – and raising a ticket should help resolve this.

Nope. Not really. I have to pay that extra sum to SCB within my billing date, with no concessions – and they informed me that they will take 45 days (minimum) to up to 60 days to resolve this issue that they caused! This means I have to pay SCB 10,000 BDT for more than 45 days because they can’t figure out a basic payment failure in time due to their system fault. My money. Stuck with you guys for 45 days! I mean, 5 days is a standard ETA on this. 10 days is okay. 2 weeks is acceptable. But 5-8 weeks? Bruh you lazy af.

Update: In reality, it did not work out in 45 days. The money hit my bank sometime on March 2022. This is 3 months later, which means that I will only be benefited by this sum on 2nd of April (my billing date). This means that by now, I have been unfairly forced to pay 10,000 taka to SCB, which they held for 3 whole months (around 90 days). At the current rate of inflation at 6%, I lost 200tk in this process and a few of my hairs with it. In burger terms, I lost a whole Chicken Cheese Burger with extra Sausage from Burger Xpress. Which is quite unfair because none of this was my fault.

48. On the 19th of January, 2022, I spoke to SCB over the phone to allow me to make a single 355$ transaction using my credit card. SCB informed me that their limit is 300$ and there is no scope of changing this because there is a cap on this. Although Bangladesh Bank allowed it back in Sept 2021 (news), and my transaction is eligible to bypass this limit – SCB was not informed about the matter almost 4 months after the notice and had no scope of bypassing this limit on their backend. Instead, their personnel asked me to request a foreign entity to change their website and take payment in 2 parts instead because their restriction is from the BB and they have nothing to do here. Note that no such restrictions exist, and BRAC Bank does provide this service (they confirmed to me on the same date), and just asking them over a call to unblock a certain payment is usually adequate. Later, I learned that EBL also provides the same service – so the BB Limit is imaginary.

49. I live in Mirpur. Do you know where the closest Branch to me is? It’s in Banani, which is a 1-hour 30-minute ride away, at least – on a good day. On a bad day, it takes me at least 2 hours or more. Do you know where the branch closest to Banani is? A 10-minute ride away in Gulshan 2. Do you know where the closest branch to that is? It’s a 10-minute ride away in Gulshan once again! If you travel another 20 minutes, you will find another branch in Tejgaon. Five minutes away, there is a branch near Panthapath. Who decided to bunch together all branches in one place and completely forgo the rest of the city like that? If you don’t want people to come to your branches, why do you maintain so many branch-based services that cost me time and money, and effort to reach out to you for silly things that could have been handled online very easily?

50. Notice the image below. On the left, you will notice that I received 3964+2500 in two different transactions on the 29th of January. The screenshots are from 30th January (well past 3 PM) so I assume it has been more than 24 hours since these deposits took place. Yet, my Inbox Notifications do not display these transactions. Neither does my SMS/Email thread. More annoyingly, there is no information whatsoever regarding where the money came from. What bank did it come from? Who was the user? Why is there no additional information here? Why should I have to guess where the money came from? What is this?

51. This is the year 2022. Technology has progressed so much that humans are now capable of living on Mars quite comfortably. SCB still has not figured out how to allow me to log in to two different phones at the same time. I have two phones. Why should I be forced to choose one over the other? What if one is near my bed and the other is in another room? Why can’t I just automatically get logged out of the other instead of this nonsense? You allow me to log in and perform the same set of actions from two different desktops. So why not here?

53. This is a repeat – but the problem is repeating in multiple ways so it’s necessary for me to mention this again. Notice the SMS screenshot below. That says my bill is paid. See the one sent 1 day after the previous one? That says I haven’t paid and it’s still due. Why do you want to confuse me in so many different ways? How have I hurt you? How can my statement (generated automatically many hours after payment) not reflect my latest payment that you have already recognized as paid via SMS and Email (and cut my money off from my account too, so it’s not like you don’t know at that point)?

54. This is the 13th of March, 2022. The world has a lot of problems. Russia is in a war with the rest of the world. We just forgot about Covid one fine morning. But Standard Chartered Bank is yet to figure out the fact that my Available and my Current Balance can’t be different figures. Yes, I had 56,624.03 in this account. Yes, I know I had a 5000tk deposit from an SCB account. No, it is not acceptable that hours after that transaction, SCB hasn’t managed to add that line item to my Account History even though they have already added it to my Available Balance and I am already allowed to spend that money.

Update: I realized close to a year after writing this that this value is okay and the Current Balance here is only for the specific row (what the value was after a certain transaction). I understand that this is how accounting guys look at their financials – but this is not how we read a table (we expect the last data to be a summation). This is terrible UX and needs improvement for sure.

55. Guys, super uncool that everytime I reload your page to see updates, you log me out automatically. Like, it was a reload. I am not trying to hack into the Norwegian Sovereign Wealth Fund. I reloaded my dashboard. Why would you log me out?

56. What does “Finance Charges” mean? Against which finance? Why is your finance charging me money? Where did this come from? At which rate? Why are you trying to hide the fact that you charged me money to transfer a Credit Card Transaction to Flexpay/EMI although this “Finance Charge” was not mentioned anywhere within that application form and was not approved of? Why are you hiding a transaction as small as 100tk? Do I trust you more after noticing this, or less? Why do I have to call and ask people what this means? How do I get a reference to this transaction? What if I applied for two EMI’s? How do I know which one is which? How do I know how this was calculated?

57. On the 16th of April, 2022 – I tried to do a purchase via my Credit Card (and my Debit Card) – which failed without any logic even after 4 tries. Why the bank was refusing the transaction – only they know. But it was a pretty time-sensitive transaction, and I had to resort to BRAC Bank to do it later (which worked fine, so it wasn’t an issue with the payment processor).

I then resorted to calling the SCB Helpline and spent 12.5 minutes in the waiting line. Nobody picked up. I spent a little over 28 taka on the call listening to that horrible waiting message. Nobody bothered to call me back later. I did not receive an email regarding why the transactions failed out of nowhere. I could not contact my bank at that time either.

This also means that if I needed to call the bank to unlock my foreign transaction part – I wouldn’t have received any help at that hour. Now, don’t tell me that there were millions of people calling at that hour either. It was 12:30 AM – and I am certain that the call center just did not have anybody working at that time. I understand that it’s Ramadan and there can be trouble manning the shifts – but it’s quite unacceptable that I am forced to contact the bank and spend my money and you aren’t even telling me that there isn’t anybody behind the counter or even someone who bothers to call me back.

I can accept the loss of money and the lack of service, but why waste my time?

58. It is April 25th, 2022. I called SCB’s helpline to request for my Credit Card’s Foreign Part to be activated. I was informed over a call that their system is down. VISA isn’t down. SCB’s internal application that allows them to turn it on and off is down. I had a very emergency transaction that I must make within 3 hours. They have no ETA on how much time it might take them to fix this.

At 10 AM today, my RM was supposed to email me a file from SCB. He told me almost 1 hour ago that he sent it. But I haven’t received it yet. Checked multiple times. No email. I use Gmail and they aren’t down. So I am assuming it’s SCB’s fault and probably their servers are down altogether. I have a meeting that’s getting delayed because I am supposed to wait for this file and sign it before I take off.

What a terrible day to be an avid fan of SCB 🙁

59. Followup on the previous issue:

I received the email after almost 1.5 hours. Makes sense. Technical issues can happen. No biggie. I was sent some paperwork as a .7zip file. With a passcode. I downloaded the 7zip extractor to try and extract it. I knew the password (123, terrible choice, I know). It wasn’t working. Couldn’t extract it. I am a CS Grad. If I can’t figure it out, then my father can’t either. He is an SCB Client. You shouldn’t be doing this to him.

I was getting super delayed.

My RM was very helpful. He took pictures of the form (from his monitor), and sent me pictures of the form from his monitor to my WhatsApp. He couldn’t send the file to me directly. Weird. But okay. I love the effort. And I love the fact that he was trying to make my life easier. Fantastic.

But I didn’t feel like printing something that looked so weird and signing that. Felt unprofessional.

I decided to upload the file to a random zip file unlocker. It managed to unlock the file (I didn’t have to give the password – they brute-forced it in ~2 minutes). I downloaded it, printed 3 pages of it, signed 2-3 mandatory places, scanned it, and emailed it back. Took me like 20 minutes to finish the process.

Sounds fantastic. Good service.

But only if you have never heard of services like DocSend, Adobe Sign, Highspot, PandaDoc, HelloSign, etc. I mean, it’s 2022 guys. You can take a signature digitally. Look it up. It’s dependable, quite simple, and takes barely a minute.

Why are you making me unzip a file, print 3 out of like 50 pages, and then sign it manually, and then scan it, and then email it back with very specific email instructions (like how I have to attach that same zip file back to the email)? Why would you do that to me? Just ask me to reply yes to that email. Just send a URL where I can put in a digital sign. Or build it inside your web application. Please do something that is not so terribly designed. Can you imagine a 60-year-old doing this? Those guys are your biggest clients!

60. Let’s say you got inside your App to send someone a little money. You need to send them the transaction details as proof of payment. Sounds easy. But not really. First off, you can’t take a screenshot in the app. Second off, you can’t copy off the transaction details either. No option appears. Almost as if someone really dumb made this. How are screenshots from my app harmful? Why can’t I just copy off the huge transaction ID? Why do you want to make my life so difficult?

Nevertheless, you imagine that it will just be simpler to log into the web application and take a screenshot, right? Well, you walk to the other room, get your laptop, and turn it on – only to discover that SCB won’t let you log in because you logged in to your app 20+ minutes ago. Why can’t you just end that session? Why not just let me log in here and block that session if the sessions concern you so much? Why do I have to call the bank for further assistance regarding a digital service? Why the unnecessary hassle for me?

Update on June 30, 2022: I am unable to log in due to this stupid reason once again. My phone and my desktop are right in front of me. I am not logged in anywhere else for sure. This is the 2nd time today that I am facing this issue, in a span of 2 hours. What kind of session ID hasn’t expired in 2 hours? Why was I forced to call the bank and spend 8 minutes and 16tk on the phone to get myself unlocked out of a problem I did not create?

61. Today (Jan 2023), I was charged 40 paisa for the 7th installment of a 6-installment EMI. Yes, you read that right. How there can be a 7th Installment out of a 6 Installment EMI is one problem. The fact that this system doesn’t validate installment counts is another problem. The annoying problem is that it will cost me 50tk to figure out why I was charged this 0.4tk installment.

62. This is the 4th of June, 2023. Everybody at work is pissed because SCB has not deposited our salaries on time for the last two months. They made two commitments over last week and failed those – which makes it a 5-day delay of sorts. Why money from the bank can’t be deposited in a few minutes instead of requiring manual intervention – I won’t ever understand.

Anyways, this got me to a strange event when SCB deducted an EMI from my empty bank account and left an odd value on the UI. Why does it say Available Balance when there is no available balance? Apparently negative bank balances are denoted with a DR at the end of the text – because a negative sign would be too mainstream and usual bank customers are expected to take a lesson on Terrible Banking UX to learn what their homepage says. Who thinks of these? Why do they have jobs?

63. I paid my Credit Card Due partially from another bank. Within minutes, I received an SMS from SCB saying that my balance is partially paid off and they have received it. It has been 2 hours since then, and the Dashboard has not updated yet to reflect the original due amount after the payment. Keno bhai?

64. This is August 2, 2023. For the last 72 hours, I have been struggling with the SCB App. I can’t send money anywhere because the OTP/eTAC never comes to my number, and nor do I receive the OTP via email (it came once to my email the last time). Something is down. On Sunday the whole app was down through the whole day and I could not even login. My money is stuck in the bank. I really need to transfer to bKash so that I can do a transaction. But there is no way to circumvent the OTP issue. They don’t support any Authenticators, or other alternatives. There is no way for me to get a set of passes that I can store for days like this. This is ludicrous. Who designed a system without a failsafe? I have a guy waiting in front of a store who is expecting money. Now I can’t access my own money and have to go somewhere else to find a non-existent ATM network and spend money to cash out a small sum? I then spent 15 minutes on the helpline to try and raise a complaint. Why would you do that to me?

65. This is November 2023. I was mailed my Statement as a .7z file (a 47 Kilobyte file was zipped down to 39 kilobytes). A 7z file cannot be opened on an M1 Macbook. It is password protected and the default MacOS unzipper can’t work with it at all. My office MacBook does not allow me to install the 7ZIP unzipper because it is not available on the official App Store (and it does not even support the M1 Macs even if I can get permission to install something off a non-registered developer). Whoever at SCB decided to send a PDF file after 7Zipping it in a proprietary format to reduce 8 kilobytes is an absolute idiot who does not understand his corporate users. I could not use the file. I could not view it. I could not even print it without finding a personal computer with Windows installed on it. There is no excuse for giving so much unnecessary pain to its users for something that adds absolutely no value.

66. This is November 2024. I wanted to get a statement for the last year’s TAX returns. Guess what – they wouldn’t allow me to request for a statement online with this odd and stupid limit. This is the 1st complaint I ever had (and how this whole thread started). But I want to keep mentioning this until they fix it. Now I have to go and call them and ask for it to be delivered over mail and get charged for it. Or I have to go there and pick a copy up myself. So it is really annoying every single year.

67. This is almost the end of 2024. Christmas is in a few days. It was today that I realized I can’t get a loan statement from Standard Chartered Bank online. I can either visit a branch, or wait a week and get a paper over mail. Just a scanned copy isn’t their thing. No expedited deliveries possible either. The only usecase of this is that I will scan it and send it to someone. But SCB seems to disagree about the use case and thinks I really need a physical copy. Very unimpressive. BRAC Bank just mailed theirs over in like 30 seconds. Wake up guys. Its no longer the ice age!

—

So yes – if you have bothered to read till the last – I am hurt and annoyed that nobody has fixed these over the years. I have complained multiple times and given feedback on multiple of those feedback screens (that have a character limit – urgh) – so now I am just downright annoyed at the lack of change/initiative to even fix one of these.

Thus, I will continue maintaining this public blog listing everything else that I notice until someone decides to care.

Yes, this article had a different name before because I started with 16 issues and now I am at 67 and counting. Yes, the formatting on this is a little weird. Not my fault, I promise. This theme is too old and bonkers.